Introduction:

Filing taxes can be a breeze if you follow a simple and efficient process. In this blog post, we’ll guide you through the hassle-free method of filing your taxes as an employee using ClearTax and Form-16. By submitting your investment proofs to your company on time and leveraging the user-friendly ClearTax platform, you can smoothly complete the entire tax filing process online. Let’s break it down into easy-to-follow steps.

Step 1: Submit Investment Proofs :

Start by submitting your investment proofs to your company before the designated deadline. This ensures that your tax-saving investments are considered during the computation of your taxable income. Common investment proofs include documents related to provident fund contributions, life insurance premiums, and other eligible deductions. This step is crucial for accurate tax filing and helps you maximize your tax savings.

Step 2: Obtain Form-16 :

Once the financial year concludes, your employer will provide you with Form-16, summarizing your income and tax deductions. This document is essential for filing your taxes and can be easily obtained from your company’s HR department. Form-16 serves as a comprehensive snapshot of your financials, making the tax filing process smoother and more transparent.

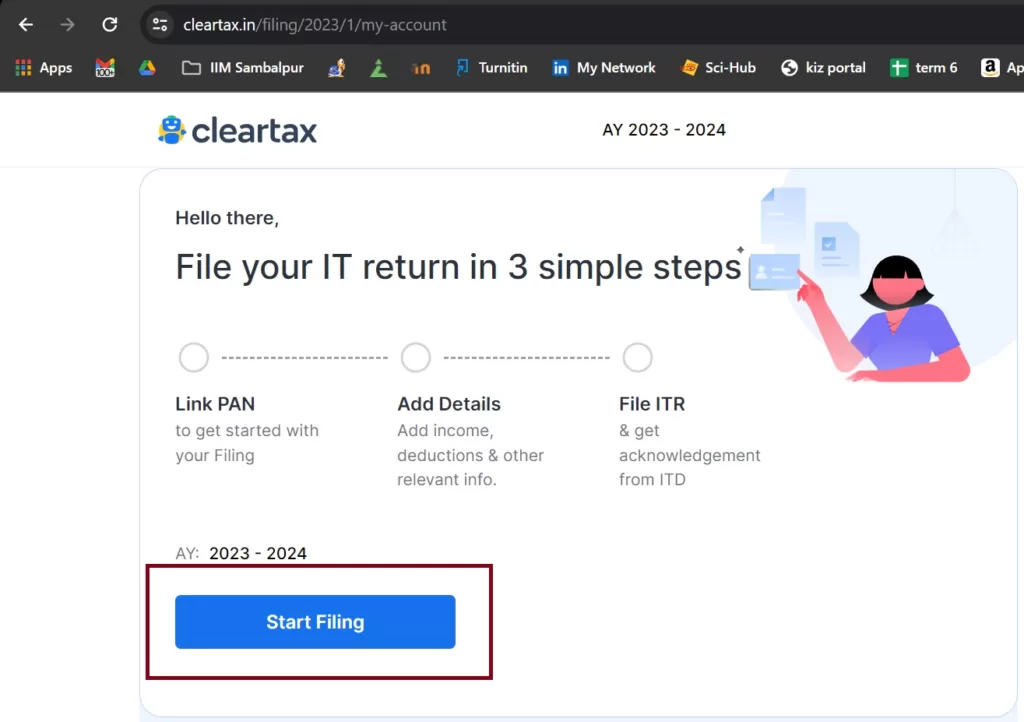

Step 3: Navigate to ClearTax :

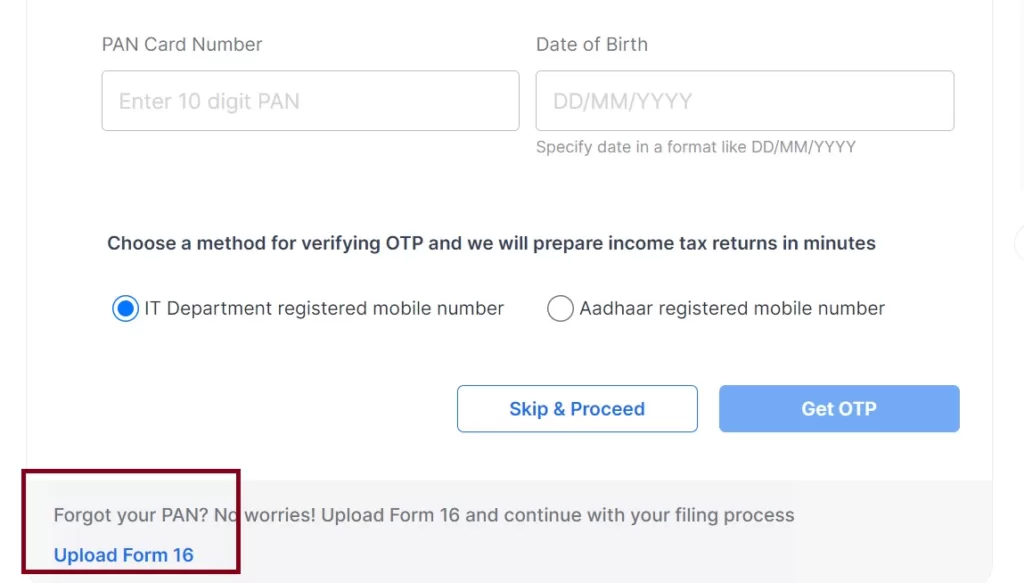

Visit ClearTax, a user-friendly online platform that simplifies the tax filing process. Create an account or log in if you already have one. Once logged in, upload your Form-16, and ClearTax will automatically populate the relevant fields based on the information provided. The platform employs cutting-edge technology to make tax filing accessible to everyone, even those with limited financial expertise. The seamless interface ensures that you can file your taxes effortlessly and accurately.

Step 4: Complete the Process :

Follow the prompts on ClearTax to review and verify the populated information. Confirm the accuracy of the details, and if everything looks correct, proceed to the payment step. ClearTax charges a nominal fee of 150/- to 250/- for its services. Make the payment through the secure portal to initiate the filing process. The straightforward payment system adds to the user-friendly experience, making tax filing a quick and painless task.

Note: I am no way related to the ClearTax website. I personally use this.

Step 5: E-Verify on Income Tax Website:

Once you’ve completed the filing process on ClearTax, head to the official Income Tax website. Look for the E-Verify option, which allows you to authenticate your tax filing with a simple click. This step is essential to confirm that you have submitted your taxes and helps streamline the verification process. By leveraging the user-friendly features of the Income Tax website, you can efficiently finalize your tax filing and ensure compliance with regulatory requirements.

Before clicking on E-verify, login to your account.

An acknowledgement number will be available after you complete your clear tax ITR filing. You will get an acknowledgement number by mail or on the Clear Tax website. After this you will get an option to confirm your Tax filing.

Conclusion:

In conclusion, filing your taxes as an employee has never been easier. By proactively submitting your investment proofs to your company, obtaining Form-16, and utilizing the ClearTax platform, you can breeze through the entire process. The straightforward steps outlined above, coupled with the seamless interface of ClearTax, make tax filing a hassle-free experience. Embrace the simplicity of online tax filing and enjoy the peace of mind that comes with efficiently managing your financial responsibilities. Happy filing!